Exchange betting is the choice of professional gamblers over fixed odds sport books and if the professionals use it there must be a reason. The availability of betting exchanges to the average punter has only been possible since the online betting revolution. The first exchange was launched in 2000 by Betfair and this form of online betting has seen faster growth than fixed odds equivalents.

Exchange betting is the choice of professional gamblers over fixed odds sport books and if the professionals use it there must be a reason. The availability of betting exchanges to the average punter has only been possible since the online betting revolution. The first exchange was launched in 2000 by Betfair and this form of online betting has seen faster growth than fixed odds equivalents.

Exchange betting is a form of peer-to-peer gambling that has a ton of advantages over conventional fixed odds books. Effectively the odds are set by you and this allows you to cut out the middle man adding value to your bets and giving you control over the markets you want to wager on.

Users have the option to set their own odds for others to bet on (laying) or take odds offered by other punters (backing). The betting exchange takes a commission (of winnings and sometimes stake loses) and all of the rest is for punter. Odds are almost universally higher on exchanges vs fixed odds and the system also allows customers to ‘arb’ whereby punters back a bet with a bookmakers and then lay on the exchange to lock in a small profit.

List of Recommended Betting Exchanges

Betting Exchange Reviews

With a long history in the industry and a iron clad mission to give punters a better deal, Smarkets is our go to betting exchange.

Founded in 2008, the company have bases in London, Malta, and LA, and have consistently been praised for their growth and technological capabilities, improving year on year both in terms of the power of their product and the markets on offer.

It’s an extremely good looking interface that is staggeringly easy to use, so for newbie exchange bettors it’s a brilliant place to start, as it isn’t intimidating and has a very small learning curve. It’s also very contemporary, smooth as silk, and good to look at. These are all areas where industry dinosaurs like Betfair are failing.

A few things that make Smarkets unique and, in our opinion, the best exchange out there, are the highest possible levels of deposit protection, diverse market availability both within sports and with politics and current affairs, and an absolute powerhouse of an engine running behind the scenes.

The great thing is that Smarkets has carved out a nice slice of the action for itself now, so liquidity is already very good and improving all the time in more niche markets, while the company has processed billions upon billions in trades over the years, with big fixtures regularly topping £250k traded for a single event.

Smarkets are genuinely one of the good guys in the gambling industry, with a product that offers tons of value, a simple and enjoyable user journey, and high levels of customer safety and security.

Commission Structure – Smarkets have a much more attractive commission structure than the likes of Betfair. A flat 2% of winnings is charged on all sports and markets, so you the service only costs money if you win. This is an industry low so it’s a big draw for punters, and the most active can even knock this down to 1%. You might also find 0% commission promotions from time to time.

Payment Options – There are no deposit or withdrawal fees at Smarkets, and minimums are low at both ends. With plenty of ewallet availability as well as the traditional debit card and bank transfer options there’s not a lot to complain about here. Most importantly, they offer a high level of deposit protection which hardly any other bookie does.

Trading Tools – There’s a good amount of data to look at with Smarkets, plus a bet builder, and a few personalisation options when using the interface too.

Sports, Pools & Casino – In 2019 BETDAQ launched a fixed-odds sportsbook which was developed in house from the Ladbrokes platform, which it still operates despite being sold back to Desmond. This is in addition to new products such as casino, virtual sports and pools betting.

Extras – Smarkets is designed for one thing and one thing only, and that is to be a stellar betting exchange platform. There is an associated traditional bookie called SBK, and although it takes odds from the exchange the two run independently on the surface. Smarkets’ political and current affairs markets are amazing though, and set them apart from the rest.

Customer Support – Available 8am to 11pm via live chat, Twitter (@Smarketstech) and email ([email protected]). The FAQ is also very good.

Conclusion – With strong liquidity that is getting better all the time, an industry low commission structure, and excellent market availability, there’s every reason to try Smarkets. Equally as important, the power behind their product is second to none, with a superb team tinkering away in the background to keep it at the forefront of technology, so it’s a solid and good looking exchange that can easily keep up with user demands. It’s also a company that is genuinely trying to give the punter a better deal. Our favourite exchange.

BETDAQ is the trading name of Global Betting Exchange Alderney (GBEA). The BETDAQ exchange has also been around since 2000, the same as Betfair, and trading since 2001. It was established by an Irish entrepreneur, Dermot Desmond, but was sold in 2013 to Ladbrokes for €30M. Ladbrokes themselves then merged with Coral and then this group was bought out by Entain. The brand was revamped and new products added, such as a fixed odds sportsbook in 2019, but BETDAQ was then sold back to Dermot Desmond in 2021 and is now in the hands of its creator again.

In the time that Ladbrokes owned BETDAQ the brand became stale and corporate and failed to match Betfair, falling progressively behind. Now it is back with Desmond again, the exchange and betting products in general are being nurtured again and this means it now has a personality to it once more.

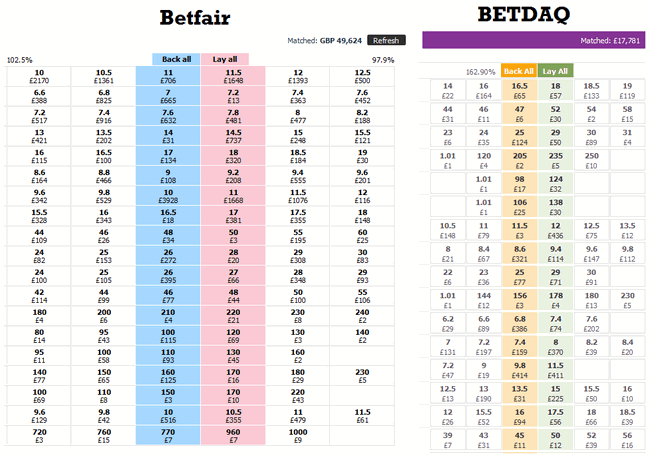

The exchange handles around £75-100M in bets each week putting it in a strong position to compete with Betfair. Of course having been part of the bigger Ladbrokes group the exchange now has a bigger customer base, more liquidity and better all around odds, so for those that like to shop around it is win-win.

Since 2019 the brand has added a full casino and sportsbook to the site making it a more complete all round site.

Commission Structure – BETDAQ have a different commission structure to Betfair. Commission is only paid on net winnings with a flat 2% from offers you make on the exchange. In fact, it is sometimes much better because you can actually get a 0% rate when certain promotions are running, although it might be on specific sports or events.

Other Promotions – This is where BETDAQ stand out and another reason to hold an account. If you want a stand alone exchange with stand alone exchange offers then this is a great option. It is common to see free bet offers for Virtuals, cashback on losses and feature 0% commission offers for some events.

Payment Options – All fee free with all major debit cards supported and well as bank transfer and eWallets, Skrill, Paypal, and Neteller.

Trading Tools – This is another area where BETDAQ are different to other exchanges. The exchange have a range of tools that allow you to customise the exchange for your needs. These downloadable features have greater usability and flexible interfaces. A proper professional tool.

Sports, Pools & Casino – In 2019 BETDAQ launched a fixed-odds sportsbook which was developed in house from the Ladbrokes platform, which it still operates despite being sold back to Desmond. This is in addition to new products such as casino, virtual sports and pools betting.

Extras – You can also place multiple bets, play games as well as playing virtuals and there is a fully functional mobile app capability and live betting is fully stocked.

Customer Support – Phone in the UK (0800 473 0009) and Ireland (01 55 66 222), email support ([email protected]), and live chat are all available.

Conclusion – If all you want is a good exchange with top liquidity, odds and options without all of the other features like a fixed odds book, then this is the exchange you will feel most at home with. The interface is clean and this does make a nice change to the likes of Betfair. BETDAQ does have some casino games however if you fancy something on the side

Betting Exchange Guides And Articles

Do Betting Exchanges Reflect Public Opinion?

Betting exchanges in recent times have actually proved to be a better gauge of public opinion than official polls and surveys. This is especially true in politics where exchanges have predicted the correct result in recent times when polls have been way off.

It is effectively because people are more prepared to put their money on what they believe than to always say what they believe. Like the old sweet jar analogy, if you get 5000 people to guess the number of sweets in a large jar then the average will actually end up being pretty close to the answer.

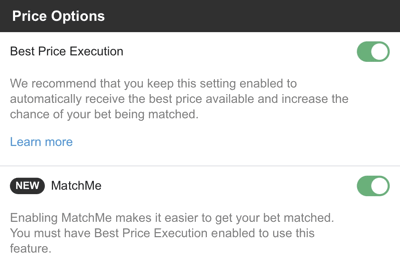

MatchMe: Exchange Back Bet Matching Feature

Those that use exchanges often will know it can be frustrating when you are trying to back a market but there isn’t someone else laying that market at the odds you are looking for to match with. The MatchMe tool works in combination with Best Price Execution.

You select the market you want to back and it will try to match your bet within a certain range automatically. This is very useful in low liquidity or fast moving markets and saves the need to constantly edit stakes, odds or cancel bets entirely.

The Battle Between Bookies and Exchanges

In the early days of online gambling the existing high street bookmakers who monopolised the industry were initially quite fearful of betting exchanges. To begin with Betfair and exchange betting was small fry and bookies labelled them as simply for nerds.

As they began to grow the big fixed-odds betting companies began to attack exchanges, labelling them as creating a platform for match fixing and lobbying in government to put restrictions on them. Ironically as time went on the bookies began to see how useful exchanges are for setting odds and even offsetting their own liabilities and eventually embraced them.

Back-to-Lay Betting

Back-to-lay betting is a strategy used by many ‘professionals’ to use odds discrepancies to guarantee a profit no matter the outcome. The strategy relies on finding overpriced markets that you back, you then lay that same selection or outcome on an exchange when the odds shorten.

It takes time, research and experience to find the appropriate markets to back and lay but the principle is always the same. Prices may change pre-event or you can use the strategy in play. Using a simple calculation you can lock in a profit no matter the outcome. This isn’t fool proof, odds can lengthen as well as shorten and often you need to cut your loses.

Who Created Betfair

Andrew Black and Edward Wray came from different backgrounds but came together with the ambition of making betting fairer for the customer. Their idea to create a peer-to-peer betting exchange was initially very difficult to get off the ground and others jumped the gun on their ideas.

Careful consideration was given to developing something better than the competition and partnering with the right people and eventually at the turn of the millennium Betfair came online. It became the worlds biggest sports betting exchange and changed the world of betting.

Why Are Betting Exchanges Not More Popular?

Betting exchanges have been shown to offer better odds in general than fixed-odds bookies, meaning more longer term value for the customer. They also allow customers to lay bets to other people to back, effectively betting on something to lose, due to the peer-peer nature of the product. The exchange itself just takes a commission.

Given these obvious benefits why doesn’t everyone use them then? Well there are drawbacks too such as low market liquidity in some markets, a lack of depth and few promotions. They are very transactional and this doesn’t suit some people who care more about the experience than the value.

- How And Why Do Bookies Lay Off Bets?

- What Happened to These Old Famous Bookmakers and Betting Brands?

How Do Betting Exchanges Work?

What is a Betting Exchange?

Exchange Betting is actually closer to what betting was like before the age of mega high street bookmakers. Effectively an exchange is a meeting place for normal people to bet with each other.

Exchange Betting is actually closer to what betting was like before the age of mega high street bookmakers. Effectively an exchange is a meeting place for normal people to bet with each other.

All you need to do is match your bet either by taking someone else’s odds price (backing) or by offering a price for someone else to take (laying). The exchange operator simply puts people together to bet in the same way a dating website would match couples together. For the privilege they then charge you a commission on your bets, but usually just your winning bets.

The concept is really simple. Find a market that you would like to bet on and then choose whether you want to back (bet on an outcome to happen) or lay (bet on an outcome not to happen) a bet. Overall value here is generally much higher as first of all you are not having to pay the bookie directly and second of all there is far more competition.

Everyone laying bets on the exchange is in effect their own bookmaker and so this is more like a single site with 1000’s of separate bookies on there. Exchanges tend to be more reflective of real probabilities and in many cases can be a measure of public opinion. For some markets like elections, exchange odds in the past have proven more accurate than official polls as people who don’t tell the truth when asked how they will vote will always tell the truth when real money is at stake.

Backing

This is very much the same as taking a bet in a fixed odds sports book, you are betting on something to occur, except that there are often several prices available to take. The odds you are given is a price offered by another person laying the bet.

Let’s say you want to bet on Manchester United v Arsenal and you want to back Man Utd to win. You will see the usual markets of win/draw/win but you can also view the full market which shows you other odds prices offered for the same outcome. The amount below the odds represents the size of the market and this is the maximum amount you can stake at that price, this can also be termed the ‘liquidity’ of the market. Better odds prices tend to have lower liquidity.

When backing on an exchange you only generally pay commission on whatever you win, if your bet loses you don’t have to pay any more than you stake. Maximum commission is usually 5% but you can get this as low as 1% with some operators or through loyalty deals.

Winnings are paid out straight away into your betting account, just like with a fixed odds book. Maximum bet amount is simply restricted by the size of the market although minimum bets tend to be a little higher than on a fixed odds book at £1+, this is simply because smaller bets are not worthwhile for the operator due to low commission rates.

Laying

If you lay a bet you become your own micro bookie. Here you are in effect betting on an outcome will not occur so you offer an odds price to someone else who thinks it will occur. You can choose to jump on the bandwagon and offer the same odds as the others or be unconventional and make an offer to the market.

If you lay a bet you become your own micro bookie. Here you are in effect betting on an outcome will not occur so you offer an odds price to someone else who thinks it will occur. You can choose to jump on the bandwagon and offer the same odds as the others or be unconventional and make an offer to the market.

When you make an offer to the market you propose an odds price and a maximum liability (this is the maximum you are prepared to allow others to stake on your bet), lets say £100 at 2/1. This means you will take bets up to £100 at that price. With some exchanges you can also set this by payout rather than liability, i.e. the amount you want to win. Either way if you win you get to keep whatever was staked on your line minus the commission to the bookmaker (less than or equal to 5% depending on your exchange and any loyalty deals). If you lose you lose whatever people have staked up to your maximum liability.

You can only have a maximum liability less than or equal to your account balance.

Matched and Unmatched Exchange Bets

Matching is simply pairing someone laying a bet at a set price with someone else who wants to back a bet at those odds. When you back or lay on an exchange you can choose to take odds where there are already offers (people are laying bets and backing bets at that price), if you take this your bet will immediately be matched and you just wait for the result. Alternatively, you can propose a new odds price by offering a bet. Your bet is only matched if someone else either lays the odds you are looking for (if backing) or backs the odds you are laying. Any unmatched bets are refunded without and commission being taken.

Matching is simply pairing someone laying a bet at a set price with someone else who wants to back a bet at those odds. When you back or lay on an exchange you can choose to take odds where there are already offers (people are laying bets and backing bets at that price), if you take this your bet will immediately be matched and you just wait for the result. Alternatively, you can propose a new odds price by offering a bet. Your bet is only matched if someone else either lays the odds you are looking for (if backing) or backs the odds you are laying. Any unmatched bets are refunded without and commission being taken.

A partially matched bet occurs when a bet is matched but not for the full stake amount. In this case you can choose to match a proportion of your original bet or wait for the market size to increase to your stake level.

When placing exchange bets, it is often a balance between getting the best price and making sure your bets match. If you are laying but at low odds few people will stake but if your backing at high odds the market may have a more limited size. It is all about risk management, you are pitting your you want to make guess as a punter against somebody else, and that is part of the fun.

For those that do not want the hassle of having unmatched or only partially matched bets could consider the MatchMe tool from Betfair (click to read more). This sets an odds tollerance to help match bets for the full stake in volatile markets.

What is Market Liquidity and Why Does it Matter?

The liquidity of an exchange market is the amount of money available to either stake (if backing) or the maximum liability if you lay a bet.

The liquidity of an exchange market is the amount of money available to either stake (if backing) or the maximum liability if you lay a bet.

Liquidity is effectively defined by the number of offers available at that given price. The amount of money in matched bets is usually displayed above the market. Bigger events (e.g. top premier league game) will have higher liquidity than a smaller event (e.g. a snooker game).

Within an event major outright (W/D/W) lines will have a greater liquidity that a smaller market (correct score). Big exchanges such as Betfair have massive liquidity and for smaller events in particular if you would like to stake a fair chunk of cash you will be better off with the Betfair. For most regular bets however you should find all exchanges have sufficient liquidity for the average punters needs. As we always say at OnlineBetting you should open several accounts and then pick the exchange betting site with the right price and liquidity for the event you want to bet on.

Market Availability and Bet Types

Effectively everything that is available on a fixed odds sports book is now also available on a betting exchange. You can bet on outrights, over/under, handicaps, you name it someone will be offering a line or willing to back it if you offer it. As soon as you start betting on an exchange you will immediately see the better raw value compared to a fixed odds book. It is

Where exchanges are a little different is with bet type availability. You can now bet on multiples with most exchanges including straight multiples and full cover bets such as Lucky’s, Yankees, etc. If however you want to place more complex bets such as forecasts, conditional bets or speciality bets you may need to go to a conventional fixed odds book.

What is a Betting Exchange Commission?

If you are backing a bet and you win you pay commissions on your winnings, if laying a bet and you win you pay commission your winnings. You can see here how the bookie earns commission either way as when someone wins somebody else has to lose. If the bet is void no commissions should be charged.

If you are backing a bet and you win you pay commissions on your winnings, if laying a bet and you win you pay commission your winnings. You can see here how the bookie earns commission either way as when someone wins somebody else has to lose. If the bet is void no commissions should be charged.

Some exchanges may charge commission on both winnings and lost stakes. This way the operator is earning twice from every transaction by taking commission from the winnings and the losing stake. This only usually happened with exchanges that have really low commissions in the first place anyway so it is a balance. Would you rather pay higher commission but just on winnings or lower commissions but on both winnings and loses? In general commission rates are between 1-5%.

Bookmakers vs Exchanges

There are several big advantages and several significant disadvantages to betting on an exchange over a sportsbook. I would recommend you have an exchange account and a fixed odds sports book account, this way you get the best of both worlds. You can do this by opening an account with a betting site that does both such as BETDAQ or Betfair who both offer exchange betting and a fixed-odds sportsbook.

Advantages of Exchange Betting vs Fixed Odds

The biggest advantage has to be the better raw odds value. Odds prices on exchanges are around 20% better on average than fixed odds but for some markets it can be over 100% better. The reason behind this simply is competition.

The biggest advantage has to be the better raw odds value. Odds prices on exchanges are around 20% better on average than fixed odds but for some markets it can be over 100% better. The reason behind this simply is competition.

In a normal fixed odds book a trader sets the odds based ultimately on their own opinion of how much the market is worth. They take into account punters interest in the market (number of bets and amount wagered) in addition to personal knowledge about the event. They also look at what the other bookies are doing which is why odds don’t vary much between fixed odds betting sites. In general, a trader will be conservative simply because they have a job to do which is make the bookmaker money.

On an exchange you have thousands of micro bookies all with different opinions on what is worth backing and laying and at what prices. This means it is highly likely you will match your bet with someone of the opposite opinion. As you only have your own money to win or lose bettors are not constrained by the same rules as traders and so in general prices are always better.

A second reason an exchange has overall higher value is the lower commission taken (5% or less) and the nature of how an exchange earns money. A fixed odds sports book will operate on higher commission rates simply because they want to earn a profit and also because they don’t know who will win. If a fixed odds bookie is over exposed on a specific book they could stand to lose money. An exchange operator however will never lose, all they do is match bets and then get commission whoever wins.

Finally, an exchange gives you the option to arbitrate and mitigate your risk. By backing on a fixed odds book (or another exchange) and laying on an exchange you can guarantee yourself a small profit (or mitigate any loss). This is one reason why people call exchange betting a living and the main reason why professional gamblers use these more than fixed odds books.

Disadvantages of Exchange Betting vs Fixed Odds

One disadvantage of exchanges is market availability. Although big exchanges like BETDAQ have a huge number of markets, and certainly far more than they used to, they will never offer as many lines as a fixed odds book. For more obscure lines you may need a normal bookie. For smaller events too or obscure betting lines you may find on an exchange that the market liquidity is low. If you want to stick £1000 on a minor Danish third division team for example you are probably not going to get anyone to match that bet in an exchange so you may have to go for fixed odds.

One disadvantage of exchanges is market availability. Although big exchanges like BETDAQ have a huge number of markets, and certainly far more than they used to, they will never offer as many lines as a fixed odds book. For more obscure lines you may need a normal bookie. For smaller events too or obscure betting lines you may find on an exchange that the market liquidity is low. If you want to stick £1000 on a minor Danish third division team for example you are probably not going to get anyone to match that bet in an exchange so you may have to go for fixed odds.

Exchanges rarely run offers and promotions, well certainly not on the scale of some of the fixed price betting sites. You may see the occasional promotion such as lower commission rates on certain events but in general it is what you see is what you get. This means it is sometimes worth looking a fixed odds sportsbook offers, even though the odds price on the fixed book will likely be lower than the exchange when combined with the promotion the bet may be better value. Another reason to have both types of account.

For new customer’s exchange introductory offers are generally worse than for normal bookies. It is often worth signing up with the fixed odds book to claim a far greater bonus and then betting on the exchange with any later winnings from the free bet or bonus. This is only possible with the likes of Betfair and BETDAQ that offer both products. While you can move funds between the two products you will not be able to use a sportsbook free bet on the exchange and vice versa.

Arbing / Arbitration Betting

Arbitration, or arbing as it is often shortened, in the betting world simply means playing the numbers to ensure you always win. Variation in odds between different fixed odds and exchange bookmakers means that if you back opposite results with two different operators, both with favourable odds, then you will guarantee that you win. For example, you are betting on Arsenal v Manchester City, with one bookie or exchange Arsenal, draw no bet, are 6/5 and City are 5/6 however with another Arsenal are 5/6 and City are 6/5. In this instance if you were to back Arsenal draw no bet with the first and City draw no bet with the second you guarantee yourself a small profit, this is arbing.

Although not illegal a fixed odds bookmaker could close your account if they suspect you are using them to arb. In spite of this many professional bettors can make a lot of money by arbing between different exchanges. Exchanges care less than fixed odds bookies about arbing because the exchange commission structure means the operators always makes money.

Do I Have to Pay Tax on Exchange Winnings

The short answer is no, this is classed as gambling and so the customer pays no tax either when placing a bet or when receiving winnings. Tax is charged to the operator instead as a point of consumption tax. Full details can be found in our gambling tax article.

Exchange Betting Licensing and Responsible Gambling

Betting Exchanges are regulated in the same way as conventional betting sites. All exchanges that operate in the UK must possess a Gambling Commission licence. By possessing a licence, they must adhere to the Gambling Act 2005 and 2014 and this includes protecting vulnerable people, having a proper complaints procedure and being clear and honest in their terms.

For full details see our guide articles on Gambling Licencing in the UK and on Responsible Gambling.

History of Betting Exchanges

Exchange betting is not a million miles away from trading on financial markets. Someone wants to sell something for a set price and you want to buy for a set price. Why therefore did it take so long for sports betting exchanges to emerge? Well this is mainly to do with technology. Before the internet it was difficult to pair bettors together in one place to exchange bets, it was even more difficult to do this in a market where odds fluctuate and offers change.

Exchange betting is not a million miles away from trading on financial markets. Someone wants to sell something for a set price and you want to buy for a set price. Why therefore did it take so long for sports betting exchanges to emerge? Well this is mainly to do with technology. Before the internet it was difficult to pair bettors together in one place to exchange bets, it was even more difficult to do this in a market where odds fluctuate and offers change.

The movement of the internet into people’s homes in the late 1990’s suddenly created an opening for exchange betting between the average Joe. Now you could sit at home and both back and lay bets at the right price and for the right amount. No longer did you have to rely on the markets and prices set by your high street bookmaker and it became immediately evident that by cutting out the bookie punters could get far better value from exchange betting.

The first exchange was flutter.com but this was quickly swallowed up by Betfair soon after their launch in 2000. Betfair have maintained a monopoly of the market ever since with the only serious competitor BETDAQ sitting with just under 10% market share. Exchanges are more difficult to make money from than fixed odds books and casinos and whereas Betfair have moved into all major bookmaking products fairly early on BETDAQ stayed true to the exchange model until 2019 when they also launched fixed-odds.

Fortunately, BETDAQ did not go under like the World Bet Exchange (WBX) did but were bought out by Ladbrokes in 2013. Ladbrokes had the opportunity to become a serious competitor of Betfair and equal up the betting exchange market in the UK. They never really took on the challenge though, partly because they merged with Coral and then were bought out by Entain who didn’t fancy exchange betting due to the lower profit margins. Ladbrokes sold BETDAQ back to its original owner Dermot Desmond in 2021 and no longer offer exchange betting.

In the early days there was somewhat of a battle between the old traditional high street bookies and the new exchanges. Fixed-odds bookmakers feared them and began to attack them, lobbying MP’s and suggesting that exchanges were used for match fixing. Quickly, however, bookies realised exchanges were in fact useful, in particular for setting their own odds. Later bookies would even use the exchanges themselves to offset their own liabilities to help balance books.

WBX (World Bet Exchange) CLOSED

What Happened to WBX?

The World Bet Exchange (often referred to as WBX) was founded back in 2002 by Malcolm Gray but did not launch until March of 2006. The WBX holding company was based in Notting Hill in London (England) with World Bet Exchange Limited and WBX Members Funds Limited as separate companies. This meant members funds were held separately in a trust with external auditing preventing improper use of customer funds as seen with Sporting Option’s where the owners were accused of creating their own liquidity. Sporting Options was later bought by Betfair.

The World Bet Exchange (often referred to as WBX) was founded back in 2002 by Malcolm Gray but did not launch until March of 2006. The WBX holding company was based in Notting Hill in London (England) with World Bet Exchange Limited and WBX Members Funds Limited as separate companies. This meant members funds were held separately in a trust with external auditing preventing improper use of customer funds as seen with Sporting Option’s where the owners were accused of creating their own liquidity. Sporting Options was later bought by Betfair.

It was Malcolm Gray’s intent to take his time in setting up his exchange so that he could attempt to compete with the sports betting exchange held (and still held) by Betfair. In an interview with the Racing Post before the company launched he stated “In an industry where the current market leader has a virtual monopoly, we believe the arrival of WBX will put every exchange player back in control. We will continually seek to offer a vibrant, exciting and innovative alternative to Betfair, and we hope this will promote healthy rivalry“.

The company went all out from the start to entice customers away from Betfair. They were in fact the fourth biggest sponsor of horse races before they had even launched as a betting exchange. The company created their own WBX Hurdling Tripple Crown sponsoring the Fighting Fifth Hurdle, the Christmas Hurdle and the Champion Hurdle.

WBX attempted to win customers by charging around 35% less commission than the Betfair Exchange. In just two years the model seemed to be working well and in 2008 the company reported over £500m in bets on the WBX exchange.

On March 16th 2015 WBX announced it was closing and it did so the same day. This highlights the difficulty in making money from exchange betting. Compared to fixed odds markets commissions on Exchanges are far lower. At the time that Betfair were pumping money into generating cross-products (casino, fixed odds, bingo, etc) WBX stayed true to exchange betting, simply trying to be the best exchange in the world. Not matter how much better you though WBX was than Betfair in the end the company simply could not compete with the Betfair portfolio. Most betting exchanges now run other products in order to prop up the exchange after the lessons learned from WBX.

What Happened To The Ladbrokes Exchange (Closed)

Ladbrokes entered the exchange betting market when they bought BETDAQ back in 2013 from founder Dermot Desmond. This was at a time when BETDAQ were struggling and Betfair were dominating more and more. Betfair by this point had expanded their product services to include a fixed-odds sportsbook, casino, slots and all the other verticals that are ultimately more profitable for betting companies.

Ladbrokes entered the exchange betting market when they bought BETDAQ back in 2013 from founder Dermot Desmond. This was at a time when BETDAQ were struggling and Betfair were dominating more and more. Betfair by this point had expanded their product services to include a fixed-odds sportsbook, casino, slots and all the other verticals that are ultimately more profitable for betting companies.

Following the purchase of BETDAQ Ladbrokes effectively implemented their exchange on the Ladbrokes site but it was just a feed of the main BETDAQ exchange. Ladbrokes pushed it for a while and even ran dedicated welcome offers. When Ladbrokes merged with Coral in 2015 the exchange seemed to go on the back burner. The Ladbrokes-Coral group were then bought out by GVC a year later (now Entain) to become part of a multi-billion super betting group.

Frankly Entain didn’t really like the exchange part of the business, it was too small fry for them and possibly not worth the up keep and investment needed to make it properly competitive with Betfair. Instead Entain focused on monetising BETDAQ in a better way. They launched a fixed-odds sports book on BETDAQ in 2019 along with casino and gaming products. The idea was to make BETDAQ more profitable but ultimately the exchange was put on the back foot.

In 2021 BETDAQ was sold back to its original owner, Dermot Desmond, and that spelled the end of the exchange offered on Ladbrokes. In reality it was only ever part of BETDAQ anyway so if you want an alternative to Betfair go with them or Smarkets, as these are the only other serious exchanges to bet with.