Bookmakers have been in operation for quite a considerable number of years now. In fact, the very first bookmaker – Ogden – stood a Newmarket in 1795. Bookies were created by Harry Ogden, and he pretty much created the world of sports betting. Yet, in the years proceeding, many others have come to light, opening their doors and allowing for a bigger market to be created in the process.

Bookmakers have been in operation for quite a considerable number of years now. In fact, the very first bookmaker – Ogden – stood a Newmarket in 1795. Bookies were created by Harry Ogden, and he pretty much created the world of sports betting. Yet, in the years proceeding, many others have come to light, opening their doors and allowing for a bigger market to be created in the process.

It didn’t take long for this to become a problem, as the government was unable to control the spread of bookmakers and people making profit from it. Therefore, a law was created so as to regulate the industry, even way back then. The result was the Gaming Ac of 1845, allowing bookmakers to operate everywhere apart from at racetracks.

Unfortunately, that law did very little to curb new businesses opening their doors, with illegal bookmakers continuing to operate throughout the United Kingdom. It wasn’t until 1960 that the Conservative government of Harold Macmillan introduced the Betting & Gaming Act.

That legalised betting shops on the UK’s high streets, allowing for many big names to become operational in the country. However, some of these prolific names in the bookmaking industry are no longer in action. Why is this? Well, that’s precisely what we’re going to look at here. Which brands are known as some of the oldest and most prolific? And what exactly happened to these old famous names in the bookmaker world?

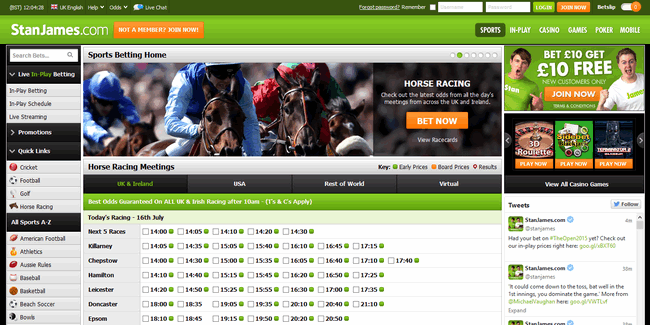

Stan James

The Stan James brand actually started operating in 1973, beginning life as a single betting shop based in Wantage, Oxfordshire. Founded by Steve Fisher and James Holder, the company was named so by taking the first two letters of Steve and his wife Anne’s first names (Stan) and from James.

Throughout the years since its humble beginnings, Stan James grew to become one of the UK’s most trusted names when it came to betting and gaming. The company launched its online operations at StanJames.com, after being granted a licence to do so by the Government of Gibraltar and the UK Gambling Commission (UKGC). Both sports betting and casino gaming could be participated in at the platform, and it accepted gamblers from over 120 countries at one point.

In September of 2015 though, the Unibet Group Plc acquired the rights to Stan James Group Plc for £19 million, and by February 26, 2018, all Stan James accounts were transferred to Unibet. This led to the complete closure of the Stan James website, with all rights and assets being soaked up by the Unibet brand.

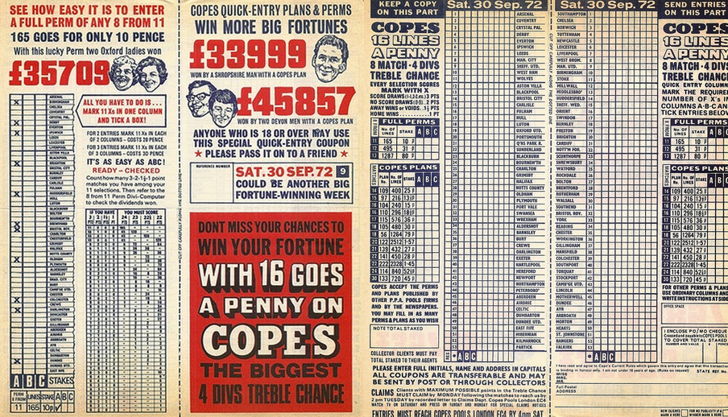

Littlewoods and Vernons Pools

The pools have been considered one of the UK’s biggest draws when it comes to gambling. This is due to them generally being cheap to enter and often encouraging players to place several bets because of this. Frequently, the most popular game was one known as Treble Chance, and that now goes by the name of Classic Pools. Traditionally, entries would be submitted through the post or via an agent, who collected pools for the specific area they resided in.

Littlewoods and Vernons made up two of the largest pools companies, with Littlewoods being the very first to offer the service. It was in October of 1922 that John Moores, Colin Askham and Bill Hughes heard of a man called John Jervis Barnard, who had devised his own football pool. This would see punters bet on the outcome of football matches, with the pay-outs to winners coming from the pool of money gathered from everyone.

A total of 10% would be deducted for “management costs”, but Barnard was struggling to properly get it up and running. Hughes managed to get his hands on one of Barnard’s coupons and the three men believed they could make a better run of it, selling them from the outside of Manchester United’s Old Trafford football ground under the name of the Littlewoods Football Pool.

A small office was rented in Liverpool, and the first 4,000 coupons ended up being distributed in 1923. Initially, this wasn’t a success, with only 35 coupons being returned. Bets totalled £4 7 shillings and six pence – or £4.37 ½. Therefore, the 10% deducted for the three men did not cover their own expenses. This led to them printing 10,000 coupons, taking them to Hull and handing them out before a big game there.

Yet, only a single coupon was returned at that point. Hughes and Askham agreed to pull out of the scheme, no seeing any profit in it. They both expected Moores to agree, but he instead offered to return the £200 that they had each invested in return for their shares in it. This was accepted by both men, and by 1930, Moores had reached millionaire status.

Vernons opened in 1925 and another large company called Zetters in 1933. Business went on uninterrupted for many years, and it was in 1986 that a syndicate of players became the first to win prize funds of over £1 million.

Unfortunately, the popularity of the pools declined in 1994 when the country’s National Lottery was introduced. In 2007, Littlewoods and Vernons were merged with anther pools provider Zetters under the Sportech company, being renamed as The New Football Pools. Then, in 2017, the pools were sold off to the private equity company OpCapita for £83 million.

Littlewoods operated online for a while offering gambling products poker (on the cryptologic network) and casino.

After the Littlewoods gambling brand was bought out by Sportech the site was eventually was merged with Vernons, which we come to next.

The Vernons brand name was brought back as an online sportsbook and casino by in 2013 by the Netplay TV plc Group and enjoyed some initial success.

NetPlay were however bought by Betsson who have a history of pulling UK brands and they quickly removed Vernons from the portfolio. Betsson did not understand the prestige of the name or its history most likely.

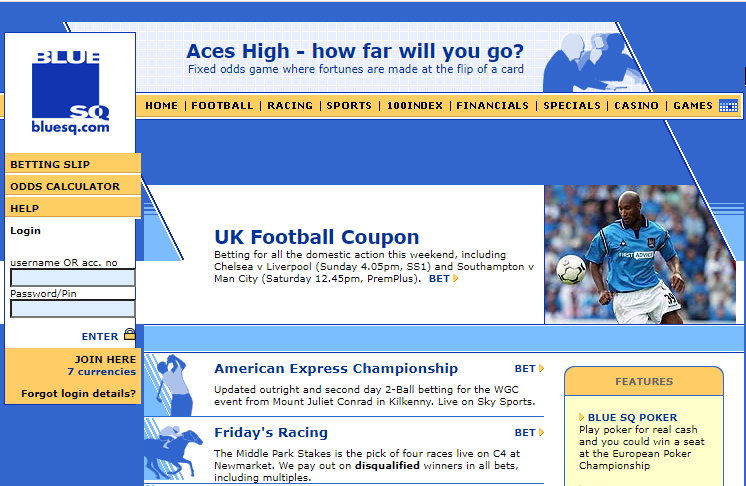

Blue Square

Many years ago, Blue Square was known in the world of betting as an interactive gaming business. It was launched in 1999, but its history dates back to the year before. When the Press Association and Mirror Group owned the website sporting-life.com, they opted to introduce a section known as BETonline for punters to access. Odds were provided at the site by City Index, and it became one of the first online sites in the UK to provide wagering on sporting events.

It was in 1999 that it became known as betonline.co.uk, and a sister brand was launched in the same year alongside – Blue Square. The two companies didn’t take long to merge into one, combining as of July 4, 1999 and operating solely under the name of Blue Square. The company operated as quite a small business for a few years, but once the Rank Group spotted it, they wanted to get involved. So, an offer of £63 million to purchase Blue Square went through in 2003, with the business coming under new leadership.

Blue Square held two gambling licences at the time of its acquisition by Rank. Those came from the Alderney Gambling Control Commission and the UKGC. Of course, the fact that it had such an international market was one of the reasons why it held such an appeal for the Rank Group. Yet, in 2008, Mark Jones became the Managing Director of Rank Group and it was his decision that the betting site should be sold.

It was then announced in 2013 that the Blue Square brand was being purchased by the popular Betfair company. Oddly enough though, Betfair only paid £5 million for certain Blue Square assets, including its customer database. Due to this, all Blue Square customers found themselves being migrated over to the Betfair platform, whether they wanted to become a part of it or not. Due to this, Blue Square ceased to exist as an entity.

World Bet Exchange

The World Bet Exchange (WBX) operated as a person-to-person betting exchange based in Notting Hill Gate, London. Founded in 2002 by Malcolm Gray, the brand did not officially launch until November of 2006. The World Bet Exchange Limited and WBX Members Funds Limited were both wholly owned subsidiaries of WBX Holdings Plc. All three companies were also registered in England and Wales. The latter of these was actually set up as a safeguard to be able to protect customer funds within a separate bank account to company funds.

The World Bet Exchange (WBX) operated as a person-to-person betting exchange based in Notting Hill Gate, London. Founded in 2002 by Malcolm Gray, the brand did not officially launch until November of 2006. The World Bet Exchange Limited and WBX Members Funds Limited were both wholly owned subsidiaries of WBX Holdings Plc. All three companies were also registered in England and Wales. The latter of these was actually set up as a safeguard to be able to protect customer funds within a separate bank account to company funds.

Prior to the launch of the online site, the company was already a sponsor of horse races in Great Britain. In fact, it was the fourth largest sponsor, with more than £250,000 of its own funds spent on more than 200 race sponsorships. To coincide with the launch of WBX in 2006, the brand founded the Triple Crown of Hurdling, and this would also serve as a complement to its sponsorship of the Newcastle Fighting Fifth Hurdle, which occurs at Kempton Park Racecourse.

The Betfair brand proved to be quite the rival, not only to WBX, but in the industry in general. So, in a bid to secure new customers for itself, WBX charged less commission on its customers’ winning bets. According to its own research and in an unpublished study, WBX claimed that its customers would have gone on to pay 35% more commission with Betfair.

Unfortunately, while it did try to take on Betfair in full force, WBX never really gained a strong enough market share to really be competitive enough. This led to an announcement being made on March 16, 2015 that the company was closing down for good. That came into effect as of 5pm the very same day, and any customer funds left in accounts were able to be withdrawn from the protected bank account. The CEO of the company noted that the rising costs of regulatory compliance and levies within the UK caused problems for WBX.

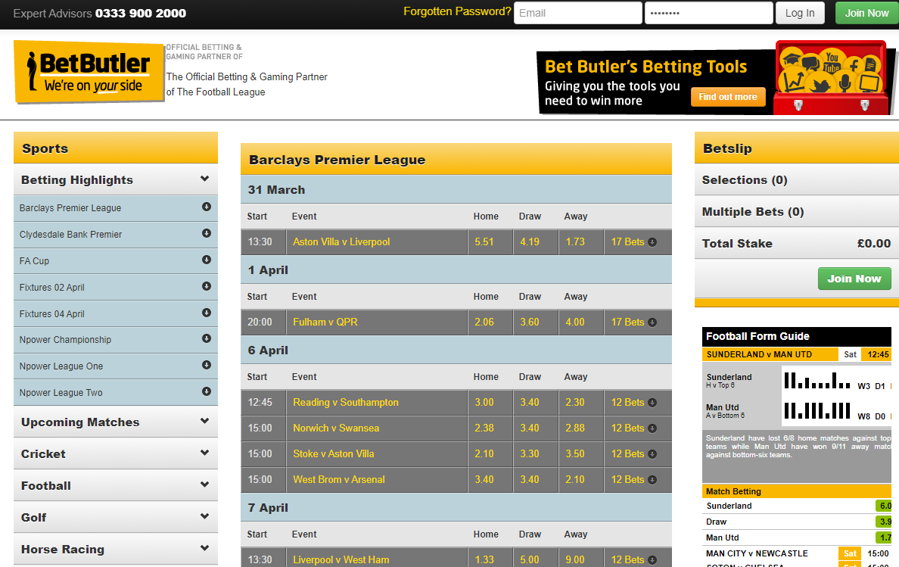

Bet Butler

Something of a more recent occurrence comes in relation to Bet Butler. This brand started operating in 2011, and it offered its customers anonymity whilst spreading their bets across different bookies. This was supposedly a good option for celebrities and millionaires who didn’t want any kind of hassle when it came to gambling online. Of course, it didn’t tailor its site to these specific people, so the general every day gambler could also sign up and use the services provided. That being said, the biggest part of Bet Butler’s customers were those with more than enough funds to spend.

Bet Butler made its money through taking commission from the bets being spread around, and obviously, if bookmakers were receiving custom from high-wagering clients via Bet Butler, even better! However, something went terribly wrong somewhere along the line, whether that was inept management or potential greed by the brand’s employees/owners.

What started out as a promising company soon found itself on the receiving end of negative press. Customers were left frustrated thanks to a surge of unanswered queries regarding payments and more, and this left Bet Butler in quite the difficult position. One Friday, the company offered all its users a £200 matched bet and the business model charged 3% commission on all winning wagers. This stood out as being quite strange, and many people questioned whether or not the company was about to go bankrupt.

Unfortunately, that’s precisely what happened. A spokesman for the company suggested that issues had risen due to the big upsurge in its customer base. Aggressive marketing had taken centre stage and many people had taken advantage of using the Bet Butler services. According to the spokesperson, a lot of money was spent on advertising, but the company wasn’t actually ready to deal with the huge inflow of customers afterwards. Bet Butler crashed and many people were owed lots of money. In September of 2014, the UKGC revoked the gambling licence of the brand. As noted in the official statement by the Commission, the reasons for the revocation related to Bet Butler not being able to carry out licensed activities in a manner consistent with the objectives set out for it. A lack of competence and unsatisfactory financial circumstances were also cited.

While the brand’s player base was bought by the Mamco company – a firm based in Curacao – for just £1, it’s unknown if all players who were owed money got it back. While Mamco did agree to refund all outstanding payments to clients, there is no evidence to support this actually happening one way or the other.