There are two things a punter can rely on when betting with a bookmaker or casino in the real-world and online.

There are two things a punter can rely on when betting with a bookmaker or casino in the real-world and online.

Firstly gambling companies rarely fail completely and those that do close down are often bought out or merged with other brands as account bases are too valuable to discard, it is highly likely any new operator will guarantee bets and deposits. Secondly UK licensed operators are required to hold customer deposits and stakes in ring fenced independent accounts in case they do fail, which should ensure bets and funds held with the bookie or casino are protected.

The betting and gaming industry is incredibly profitable, but it is also highly competitive and therefore companies, especially new online ones, are not immune to failure.

The deposit and stake protection system isn’t bullet proof either, it isn’t protected by the government like bank deposits are, and in theory it can happen that you lose your cash depending on the level of protection the bookie has opted for, which is up to individual brands and buried in the T&C’s. There are some other negatives too, even if you do get a refund you may only get your stake back for ante-post wagers and you are unlikely to get any redemption on free bets, bonuses or other promotional cash.

On this page we will look at how gambling businesses protect your money and what happens if a licenced operator does go bankrupt, form the point of view of the customer and the industry.

UK Gambling Sites Deposit Protection Levels

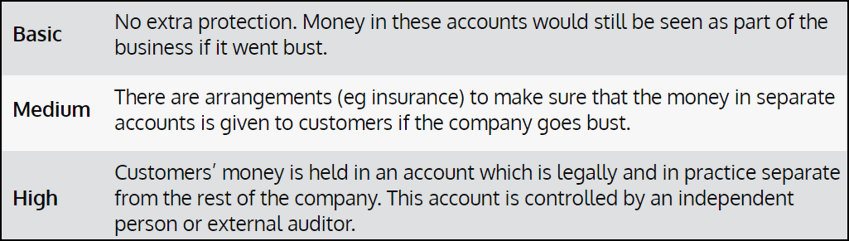

Did you know that your money in your betting account isn’t 100% guaranteed if a bookmaker or casino goes bust? The gambling commission stipulates different levels of protection of customer deposits, find out which UK betting sites provide: Basic, Medium or High levels of deposit protection.

Bookies & Casinos Rarely Go Bust

It would be untrue to suggest that no bookmaker has ever gone out of business, it is actually quite a rarity in the industry for a number of reasons. Firstly, bookies are profitable businesses that are generally well-ran, meaning that it’s far more likely that they merge with a competitor rather than completely and utterly go bust. One such example occurred in Scotland in 2011 when the owners of Scotbet, Festival Group, had suffered losses during the economic downturn.

The company had been up for sale for around twelve months, giving you an indication of how a bookie can keep going even when things aren’t going well for them. It was at that point that it was bought out by its own management team, with the sixty-five high street stores going under their control. The important thing to realise here is that there is a difference between a betting company struggling and one that is actively failing. The simply reality is that bookmakers make large amounts of profit, so a downturn in their performance might well mean that they aren’t making as much money as before but is unlikely to mean that they’ll be losing money, meaning that there’s plenty of time for them to either turn things around or find a buyer.

In the vast majority of cases where gambling companies have been failing they are merged into other larger companies. There are many management companies out there that buy up large brand portfolios, sometimes to carry the brand on or alternatively to migrate players to other brands within their network. This is great for the bettor, while you may not want to bet with the new site it should mean any funds are transferred across and you can at least get them back.

Businesses are also required to report their profits and loses, especially those based in the UK and its jurisdictions. This means it is almost unimaginable for a brand to go bust overnight, unless there were some seriously illegal accounting irregularities. There would be profit warnings and other attention grabbing headlines that should give punters plenty of advance warning to withdraw held funds and stop betting. Any betting brand with good practice would also suspend accounts well in advance of any collapse.

Gambling Companies Must Adhere To The Law

One of the main things that protects punters is the Gambling Commission, the organisation that provides the licence for any company that wishes to offer betting facilities to anyone based in the United Kingdom. Set up under the Gambling Act of 2005, the Gambling Commission’s job is to ensure that bookies adhere to said act, report any criminal activity and ensure that children and the most vulnerable are protected, among other things.

One of the main things that protects punters is the Gambling Commission, the organisation that provides the licence for any company that wishes to offer betting facilities to anyone based in the United Kingdom. Set up under the Gambling Act of 2005, the Gambling Commission’s job is to ensure that bookies adhere to said act, report any criminal activity and ensure that children and the most vulnerable are protected, among other things.

If you’d like to know more specific information then you’re best off having a look at our dedicated page on UK gambling licenses and law or our detailed guide to the Gambling Commission. If bookmakers break the rules of their licence then they’ll be fined and given a warning, which they rather obviously hope to avoid when possible. The tricky thing as far as what we’re discussing is concerned is that they are less likely to be bothered about receiving fines and warnings if they’re going out of business, but you’re still best off making sure that you only gamble with companies that have a Gambling Commission licence.

The gambling licence is also highly vetted to make sure that companies have correct procedures in place in order to get hold of one, such as separating customer money that you can read about next. The commission also makes sure that anyone who in the past went bankrupt with a gambling business will be precluded from starting new ones straight away, reducing the number of negative agents in the industry. If a business is sold the commission also makes sure that it can only be bought by a company that already holds a UK gambling licence, further protecting customers.

How Online Gambling Companies Protect Your Money

The legislation in the UK states that online gambling companies must hold customers money in a separate account to that used for running the business.

The law doesn’t however protect that money directly, as it does with funds held with banking and financial institutions up to a certain value. This means it is possible for a betting company to fail or go into administration and your money could be lost, partly or in its entirety, depending on the level of protection the company has opted for.

This seems a bit unfair and random for the punter, how are you supposed to know what level of protection you have on your betting account. Fortunately the law does stipulate that gambling businesses are required to tell you what level of protection you have in there terms and conditions, and this falls into three broad categories shown in the image taken from the gambling commission below:

Now few of us read all of the general T&C’s when we join an online casino or bookmaker, therefore it is unfortunately only once we end up in this predicament that we would discover the level of cover on your funds.

This is one major reason to never hold more than you need in an online-wallet not protected by a deposit scheme, whether that be with a bookie or any other merchant.

Fortunately in the next section we show you, from all of the sites we list at OnlineBetting.org.uk, which ones have high, medium or low protection for customer deposits.

UK Betting Sites Deposit Protection Levels

UK gambling companies are obliged to ring fence your money away from their own business accounts. Unlike with banks however this does not however mean your funds are 100% guaranteed if the company goes bust or into administration.

As we know there are three levels of protection, High, Medium and Basic, based on conditions stipulated by the gambling commission. We have researched the deposit protection levels from the UK’s leading betting sites below, it is surprising the proportion of operators only offering basic protection and only a handful providing the optimum level of high.

High Level Deposit Protection

All the cash held in a customers account is held by an independent external company or person completely separate to the gambling entity.

All the cash held in a customers account is held by an independent external company or person completely separate to the gambling entity.

Legally this money is separate to the main business meaning customers should received in full their deposits and stakes on closure, administration or bankruptcy.

If you ever plan to make big deposits or hold money in your account for long periods it would be wise to choose one of the betting sites listed below with the highest level of deposit protection.

It is shocking really how few companies offer this high protection, including some of the biggest names in the industry.

Medium Level Deposit Protection

There is some sort of insurance or arrangement in place to protect accounts with customer funds in. This means you should get paid out by a third party should the company fail, or close to business.

There is some sort of insurance or arrangement in place to protect accounts with customer funds in. This means you should get paid out by a third party should the company fail, or close to business.

It is worth noting that depending on the level of money the company are insured for and amount you have deposited with them, there is no 100% guarantee you will get it all back in all cases, but in general this is a decent level of protection.

Even if you choose to only leave relatively small amounts in a betting account this should be the minimum level you should aim for when picking a bookmaker to bet with long term.

Basic Level Deposit Protection

Your money has no additional protection should a gambling company you have deposits with fail.

Your money has no additional protection should a gambling company you have deposits with fail.

Although customer funds are held in a separate account, should the company go under it will be counted legally as part of the business.

This also means administrations would likely use that money to pay off critical creditors first (like HMRC), which is unlikely to be the customer. The only major benefit of basic level protection is the company cannot spend the customers money on day to day business, or anything else.

It is quite astonishing how many bookie, including some big names, only provide low basic protection.

Credit Cards & Bank Protection

There is a chance if you’ve used a bank card, especially a credit card, to deposit to a bookmaker or casino that you will be covered by dual liability laws should the company go bust.

There is a chance if you’ve used a bank card, especially a credit card, to deposit to a bookmaker or casino that you will be covered by dual liability laws should the company go bust.

This means you may be able to claim all or some of any lost money back through your card provider.

Credit cards are however now banned for depositing to betting sites although even prior to this few of us use credit cards to deposit online however because of cash fees.

Most of us deposit with debit cards and the law is is less clear cut here, although many banks will still refund in many situations so it is worth asking at the very least.

What Happens to Your Money if a Betting Site Collapses?

Deposits

Any funds held in your account will be held in a separate account as detailed above. As we now know whether you get that money back depends on if the company is bought up or rescued and if not what level of protection they have.

Presuming medium or high protections are in place you should get all the money deposited in your account back. There is a chance if the money is protected through insurance rather than held independently that deposits may only be protected to a certain level, therefore if you have thousands in your account you may only be paid back to a certain level.

Active Bets

Any bet already placed but not settled will be classed the same as deposited funds, it is still held in a separate account and classed as your money, you just can’t access it within your account. These should be paid back with any deposits.

Ante-post bets are those at biggest risk if in the time between placing them and the event the operators runs into difficultly. You could try cancelling your bet or cashing it out if that is an option if you just want to cut and run. If you do leave the bet live and they go bankrupt before the event then you will at best get your stake back anyway.

Withdrawals

Any withdrawals that have already been processed at the time that trading is suspended should go through, depending if the company accounts have been frozen or not. Those withdrawing to an eWallet stand a better chance than those to bank or card due to the quicker processing times.

If your betting site does start to have issues withdraw your funds to be on the safe side. They will at some point freeze withdrawals and this is certain if the company goes into administrations. If the withdrawal fails it should go back and be counted as part of deposited funds.

One way to spot a struggling brand is if they start to become slower and slower in processing or issuing withdrawals in the first place.

Winning Bets

Getting a winning bet paid out will all depend on when the bet is settled. If the bet is settled after a company goes bankrupt or ceases trading then it will most likely not be paid out and at best you will get your stake back.

Although operators in severe difficulty could void bets before they commence, if the bet pays out prior to this then you should be paid out as normal. The issue is if withdrawals are frozen you might still not be able to get access to it, immediately at least.

In-Play Bets

It’s not very likely a bookie or casino will fail as your bet is actually in play, although in theory it could happen, perhaps if you are betting on a 5-day cricket test math. If a brand did suddenly fail the nature of modern betting is such that all but the smallest local bookies have websites that can take thousands of bets per minute, so there would almost certainly be countless live bets in play at any moment that a company began to struggle. What happens to those bets? Are you protected in any way against a failing business deciding that they can no longer operate?

In this scenario again it will depend on what time exactly that trading ceased as to whether you will get paid as a winning wager or just your stake back. What you then get back form the operator will depend on the deposit deception scheme they have in place.

Are New Sites More Risky?

In some ways new brands are more at risk of failure because, of course, they won’t have the capital reserves, product range, knowledge and expertise that allows bigger more established brands to survive a difficult spell. Then again any decent business model would protect against this, which is why you see generally newer brands have lower maximum payout and withdrawal limits and reduced exposure and markets in general.

In some ways new brands are more at risk of failure because, of course, they won’t have the capital reserves, product range, knowledge and expertise that allows bigger more established brands to survive a difficult spell. Then again any decent business model would protect against this, which is why you see generally newer brands have lower maximum payout and withdrawal limits and reduced exposure and markets in general.

New brands on the other hand don’t have the profit and account expectations that the big companies have and being a little more niche can protect smaller entities from major market failures.

A lot of new brands are white labels, meaning they run using the odds and software from third party sportsbook platforms or casino game makers. This can be good in the event of close down as funds will be protected by the licensed operator and if this is the software provider then you should be fine.

Most new betting companies either arise from previous land-based gambling businesses, investment groups or spin offs from bigger companies. Whatever method used online gambling is a seriously expensive industry to get involved with, the level of investment and experience you will need is far in excess of most other of the box industries. This tends to mean you don’t get many chancers giving it a go who might fail. If you are going to invest six or seven figures in something you are going to try to make sure as best you can that it is done properly and succeeds.

Companies In Administration

If a company has gone into administration try waiting, the administrators will be trying to sell the company to an interested party who will then hopefully take on all the liabilities, including your bets, deposits and stakes.

If a company has gone into administration try waiting, the administrators will be trying to sell the company to an interested party who will then hopefully take on all the liabilities, including your bets, deposits and stakes.

If the administrators fail to find a buyer and they are forced to wind up the business they will begin paying down creditors on a priority basis. Try writing to the administrators and requesting a refund, they are obliged to look into your request. In this scenario you would unlikely get everything back but you may get a proportion.

Administration in the gambling industry is fairly rare, companies don’t fail overnight and those that are not doing too good are usually snapped up by competitors before this stage. One problem with administration in this industry is the administrators themselves would need to have their own gambling licence, or appoint a licenced body to run the it.

This would be a fairly big complication to keeping the betting brand running while trying to find a buyer.

Investors In Gambling Businesses

If you are an investor in a gambling business then your funds are just as at risk as investing in pretty much any other private company.

Shareholders will lose there share value if the company is declared bankrupt and will receive a price per share should the company be sold.

If you are an investor in a betting brand I’m sure you haven’t come to this page for advice as you will have far more financially savvy sources. Suffice to say if you smell a rat get your investment out.

In general though the betting industry is a good one for investors due to its high returns, low margins (online) and high sell on value for existing accounts.

It is robust enough that very few investors would ever fail entirely because of a brand collapse, but that said, the industry is always at the mercy of changing regulation which can trigger downturns in share value.

Why Do Betting Sites & Bookmakers Close Down

The Bookie Loses

While we might all like to pretend otherwise, bookmakers and casinos prefer losing bettors to winning ones. It’s understandably frustrating that companies find ways to curtail those of us that are successful, but it’s not much different to any other business in the sense that it’s ultimately there to make money, not lose it. That is, in part at least, down to the way that the government has set up the rules for bookies in the United Kingdom and Ireland; they have made it so that there’s no legal obligation for them to take bets off punters who are good at what they do. If customers do better than the bookmaker wants them to then they can restrict the amount of bets they place, put a limit on the size of their stakes or simply just shut down their accounts altogether.

The main reason for that is that they don’t want to lose money. Even when successful punters do win bookmakers try to balance the books, which means even if they lose a little they tend to never lose too much on a market. In theory a company could however end up with a high proportion of successful punters, either through bad management of their own accounts or through bad luck on an over-exposed market. In this scenario there is a chance a betting company, especially if already struggling, could go bust as a result.

Online casinos don’t even have to worry about the variability of the human effect that could lead to an unlucky streak of loses. Online games are based on probabilities and random number generators, therefore payout rates are known and it is almost impossible for a brand to lose enough to go bust. Virtually all games are also run by third party providers meaning they licence the games and take a share of the profits, splitting the liability in the first place. Even if you win a massive progressive jackpot you are not taking this directly from the site you bet with and therefore there is no risk of a big jackpot win sending a site bust.

Finally most companies are insured against big wins when they do happen, further reducing any risk of going bust by this means.

Illegal Practice and Accounting

As with any industry it is possible unscrupulous agents, either at director level or a senior financial level, could decide to siphon off and steal that could lead to a company being wound up or going bankrupt if caught.

In this situation there is a criminal aspect that means there is someone at fault who you could go after through the courts to get your money back. In all likelihood however so will many other people so don’t hold your breath on getting your cash back in a hurry.

Fines – Money Laundering & Failure To Protect

Companies that fail to adequately protect vulnerable groups or inappropriately screen for money laundering can be fined millions by the gambling commission or ASA. This does happen and as the issues of online gambling addiction grow in the public eye the number and size of these fine are getting bigger (see our responsible gambling page for examples).

In reality most receive many warnings in advance of fining and it tends to be the bigger brands that are made an example out of with the multi-million fines. The chances of a company going bust because they have been fined is low, the law enforcing bodies themselves would unlikely want to cause customers to lose out through their own actions either.

Competition

Bookmaking and casino operation on the high street and online is incredibly competitive and there are many operators that deliberately undercut and undermine competitors causing them to fail. This tends to be something more obvious on the high street, where the big chains drive out independents, but it happens online as well.

Ultimately any bullying brand would likely be trying to buy up the competitor, perhaps trying to dive down the price in the process and therefore the brand shouldn’t fail entirely. Any brand that fails because of competition alone wouldn’t do so overnight and you would likely see the signs on the horizon.

Economic Downturn

It is possible that an economic downturn could tip an already struggling company over the edge, especially if they are relying on investor cash injections. The truth is however that during economic downturns bookies and casinos do very well as people turn to them in the hope they can turn stakes into larger amounts to pay off other debts.

If you think about it the gambling industry flushed between 2008 and 2012 as most other industries were forced into more austere measures.

Mismanagement, Under-Investment, Theft

Even when a gambling business is mismanaged it is fairly straight forward to run an online betting website or app and make money from it. Yes a lot of start up capital is needed but once up and running it is quite hard to destabilise a profitable brand in this industry.

Mismanagement tends to lead to slower failure that you can spot a mile off, such as ageing sites and features, clear lack of investment, stale offers, poor odds, etc. You would likely have stopped betting long in advance of any immanent collapse.

Even in the event of high-level theft, internally or externally, these businesses should have sufficient insurance to cover against this. They should also have everything under such tight encryption that it should be largely impossible.

Combination Of Factors

In reality, as with most businesses, it is a combination of factors often unique to individual circumstances that lead to businesses to fail. Sometimes these are obvious and you can get out before the ship sinks, sometimes they are hidden and a quicker collapse can happen.

It is very hard to predict what companies might fail without knowing their inner workings. What you can do is mitigate your risks by not holding too much cash in a betting account, betting with several sites not just one in case one does collapse and if you stop a brand starting to struggle get out of there.

What To Do If A Bookmaker Starts To Struggle

The first sign that a bookmaker might be struggling to maintain its business comes in the form of withdrawals being slow or non-existent. The most immediate thing from your own point of view is to get your money out of your account, so starting the ball rolling on doing just that will be important. You’ll want to keep your eye on the bookie’s site, too, as they’ll be obliged to tell you of a date when they will no longer accept withdrawal requests.

The first sign that a bookmaker might be struggling to maintain its business comes in the form of withdrawals being slow or non-existent. The most immediate thing from your own point of view is to get your money out of your account, so starting the ball rolling on doing just that will be important. You’ll want to keep your eye on the bookie’s site, too, as they’ll be obliged to tell you of a date when they will no longer accept withdrawal requests.

Obviously many punters enjoy playing long-ball via the ante-post bet method, but if that happens then you’re unlikely to see the failing company wait to see if your bet turns out to be a winner. Instead, they’ll almost certainly either pay out on those that look as though they definitely will win or, more likely, simply return your initial stake. That might be slightly disappointing, but ultimately it’s better to get some of your money back than none at all. It’s not entirely implausible that you could lose everything that you have in your account, so our recommendation would be to get whatever you can back, even if this involves cashing the bet out for a lower than stake value.

As with any business, a company is more likely to want to get you off their back if you’re pestering them, so make sure you contact them regularly in order to ask about the returning of your funds. If you’re emailing and calling them every day and another punter is just waiting to see how things develop, they’ll almost certainly want to pay you what you’re owed and leave the other customer waiting.

You can also opt to go down the route of the small claims court, if a company is still trading there is no legal reason why they shouldn’t pay you out or allow your to withdraw. If you win and they still won’t pay you can then instruct a debt collection agent, if they are UK based, or at least inform the GC who could then threaten to revoke their licence. You should contact IBAS first if your complaint is about a specific bet or payout.

Refusing to pay you your money when a company is still solvent is not a valid excuse, this is just refusing to pay you out. You can read about reasons why bookmakers refuse to pay out and how to make a complaint against a betting company on our other guide pages.