There are so many terms associated with sports wagering in general, and for the most part, you may not even really know that they exist.

There are so many terms associated with sports wagering in general, and for the most part, you may not even really know that they exist.

For most people, it is simply a case of looking at the odds on an event and deciding whether or not to place a bet on one outcome or the other. However, sometimes, it can be beneficial to bettors to learn about additional phrases and terms relating to placing sports bets.

Therfore, what exactly do value and variance mean in relation to sports betting? And once you know about that, how can you make use of that knowledge towards being more successful with your wagers?

Well, fortunately, that’s what we’re here to talk about today – the expected value and variance in sports betting. Here, we will explain variance and the importance of thinking long-term, and the key to experiencing profits as well as downswings when value betting.

What is Expected Value?

To put things simply, the expected value (EV) is a measure of what you can expect to win or lose per bet placed in the long run. This does not show any variance because it is showing the average over time. The expected value is calculated from the closing line.

To put things simply, the expected value (EV) is a measure of what you can expect to win or lose per bet placed in the long run. This does not show any variance because it is showing the average over time. The expected value is calculated from the closing line.

The closing line value (CLV) is based on the sharp bookmakers odds just before an event begins. This is known as the “true odds”. This relates to what can be considered as the best predictor of the outcome of a match. Theoretically, if you regularly bet on odds higher than the closing line, you stand to be profitable. This is termed as “beating the closing line”. Punters engaging in value betting tend to beat the closing line more than 80% of the time.

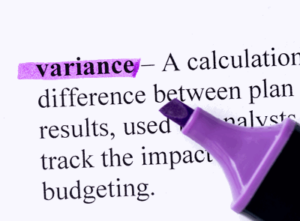

Your actual profit can still sometimes differ a lot from the closing line value, though. And it is due to variance that this is the case. Variance measures the difference between your profit and the CLV – how far a set of numbers are spread out from their average value.

It is also key to learn about the profit, return on investment (ROI) and yield measurements. These provide information on your actual results, and this all depends upon how the sports matches turn out in the end. ROI is a measure of how much your bankroll increased during a specific period. Your yield does not change depending upon the bankroll. ROI generally increases over time, whereas the yield will stay at roughly the same level.

Expected value is pretty much the mathematical foundation of any smart sports wager placed. Once you get beyond the basics surrounding point spreads and moneylines and so on, it becomes quite common to hear people speaking of expected value. Let’s take a look at an example before we proceed any further, though.

Looking Closer at Expected Value

Let’s say that you visit your preferred sportsbook and you see that it has a Premier League football match line up taking place shortly. The game is set to pit Manchester City at 8/10 (-125 in American odds or 1.80 in decimal) to secure a win over Leicester City. Before you proceed on, the question that you need to ask yourself is whether or not this is a fair line. This requires a little bit of basic mathematics, but it’s worth it in the end.

First of all, you need to give Manchester City a perceived winning percentage that you believe to be accurate. If these two teams were to play against one another 100 times over, how many times do you think Man City would secure the victory? In order to come to a conclusion on this number, you should consider things like trends, statistics, momentum and anything else associated with sports betting.

You go through the numbers in your head, and you decide that Man City has a 70% chance of winning this game against Leicester. This operates as your own true implied probability. You then need to contrast that probability with the suggested probability of the odds given, and this will determine if there is value on the line.

Convert To Percentage to Calculate the Perceived Edge

You can learn a lot more from a sportsbook’s betting odds than just what sort of payout you will receive if you place a winning bet. The odds can be translated into an implied probability, which you can then contrast with your true implied probability to determine if you have an edge or not.

You can learn a lot more from a sportsbook’s betting odds than just what sort of payout you will receive if you place a winning bet. The odds can be translated into an implied probability, which you can then contrast with your true implied probability to determine if you have an edge or not.

You just need to convert the bookmaker’s odds into a winning percentage to proceed with this.

As we are dealing with percentages it is much easier to do this using an American odds, known as moneyline, as these are show in factors of 100, like percentages. It is easy to covert American Odds to decimal and fractions, you can read more about that on our dedicated page or use any of the numerous free online tools. The formula for it is as follows:

Convert a ‘minus’ moneyline odds to implied probability:

- (- (Odds) / ((-(Odds)) + 100)

In our example, Manchester City is listed with -125 odds. So, you’re looking at the following equation:

- 125 / (125 + 100) = 55.6%

If you had a ‘plus’ moneyline odd and you wanted to convert that into implied probability, you would use the formula: 100 / (‘plus’ moneyline odds + 100) instead.

The “vig” (also known as the vigorish or ‘juice’) can also be removed from the sportsbook odds to provide a more accurate implied probability, too. This is the fee, or margin, that a bookmaker charges to a bettor for placing their wager.

If we compare our own true implied probability with the implied probability from the sportsbook odds, then it is clear to see that we have an edge on the wager, because our 70% is above 55.6%. The perceived edge is always present whenever your true implied probability is greater than that suggested by the odds from a bookmaker. To find out the exact size of the edge expressed as a percentage, another simple calculation needs to occur. This is:

- Edge = (True Implied Probability x Decimal Odds at Sportsbook) – 1.

For this, the sportsbook odds need to be a decimal. The -125 odds translate to 1.80 in decimal format, the mathematical equation is as follows:

- Edge = (.7 x 1.8) – 1

- Edge = 0.26

- Edge = 26%

That 26% edge we have calculated means that an expected profit of 26% can be expected in the long haul when betting on this line.

Now, it is clear to see that this idea is quite abstract in its working, and it only holds if both the sportsbook odds and our own expected winning percentage are completely accurate. Let’s say that we make this bet on the Manchester City and Leicester game 100 times over, and let’s say that we are betting £125 each time. For this example, it is better to assume that we live in a completely ideal world where the sportsbook’s odds are always 100% accurate, as is our own true implied probability.

From that bet, we would win 70 times over and lose 30 times, based on the 70% true implied probability mentioned earlier.

- Upon winning, we received a profit of £100 each time, based on the -125 odds.

- 70 x £100 = £7,000 profit.

- Each loss means that we hand over £125 each time.

- 30 x £125 = £3,750 in losses.

After making that bet 100 times over, we would stand at £3,250 in profit – £7,000 minus £3,750. If that figure is boiled down to a profit per bet placed, we would be making £32.50 on each of our wagers – £3,250 divided by 100. £32.50 stands as being around 26% of the £125 that we are risking each time, so our edge is 26%.

Determining a Value Bet

If you spend enough time within the sports betting sector, you will likely become familiar with hearing the term “value bets”. Finding the value bets on hand is quite simple once you understand the concept surrounding expected value.

If you spend enough time within the sports betting sector, you will likely become familiar with hearing the term “value bets”. Finding the value bets on hand is quite simple once you understand the concept surrounding expected value.

Essentially, any bet that has a positive expected value (or a perceived edge, if you prefer) can be considered as a value bet. And it is for this reason that you will often see it used interchangeably with expected value+ (EV+) bets.

There is not a single percentage to look out for as to when an EV+ wager becomes known as a value bet. After all, even the slightest amount of positive expected value will grow your bankroll over a long time period. Therefore, any positive percentage is a good one.

The trick behind benefitting from it is to strike an ideal balance between capitalising on EV+ opportunities without experiencing an unacceptable level of risk. To determine this, you need to consider the size of your bankroll and its ability to withstand variance while betting on longer odds.

Make Sure That You Look Ahead for Variance

The final thing to understand about expected value is variance. This measures how far a set of numbers are spread out from their average, as touched on briefly earlier. It becomes quite the relevant part of gambling to sports bettors, especially when considering hot and cold streaks. That’s why it is so necessary to understand it with regard to responsible bankroll management.

The final thing to understand about expected value is variance. This measures how far a set of numbers are spread out from their average, as touched on briefly earlier. It becomes quite the relevant part of gambling to sports bettors, especially when considering hot and cold streaks. That’s why it is so necessary to understand it with regard to responsible bankroll management.

Let’s use our example from earlier and say that the winning edge is 26%, as calculated. Over the series of the Premier League season, you will win around 26% on your money. However, there is the potential that you will experience a long losing streak within the long-term growth. It is vital that you are prepared for this possibility.

The likelihood is that all bettors will experience a losing streak at some point, and this may last for three or four games in a row or 7 or 8, etc.

Let’s say that you start out with a bankroll of £1,000 and you are wagering £200 per game. If you hit a five-game losing streak, that covers the entirety of your bankroll. That’s why you need to account for the variance because luck is always a factor when it comes to placing a sports bet. Therefore, you need to prepare yourself for a worse-case scenario to occur. We always recommend that you use betting units of an appropriate size, as relates to your bankroll. Rather than bet £200 on each game from a £1,000 bankroll, try smaller options, such as £20 or £50, for example.

Do You Really Want to Go Ahead with a Bet?

After completing all of the mathematics equations and finding out the end figures, you need to ask yourself whether or not you would like to place a bet on the event(s).

After completing all of the mathematics equations and finding out the end figures, you need to ask yourself whether or not you would like to place a bet on the event(s).

If we once again utilise our example from earlier, you can see a 26% edge in your favour. At this point in time, it is ideal to introduce a general rule to determine whether or not it’s a good bet to go for where you are concerned. It may be your preference to only place sports bets on games where you have an edge of at least 10%. Potentially you want to give yourself slightly more leeway, so you’ll set it at 7% or more. Different sports bettors utilise different levels to determine whether or not they have a punt.

It is key to remember that this is all hypothetical as well. Of course, with a perceived edge of 26%, the implication is that you’ll get a payout of £26 for every £100 that you wager. Of course, this is not necessarily how things will turn out in reality. Bets featuring large amounts of positive expected value often come with long odds attached to them. This ensures that they operate as risky short-term propositions, even though they have long-term value to them.

You could end up losing your wager altogether, and this will put you down by £125. Generally speaking though, the idea is that if your handicapping strategy is a good one and well-constructed with great maths, in the long-run, you’ll have the edge each and every time. This should remain true even if you lose a bet one day and then win one the following day. Essentially, you’re trying to put the edge in your favour, rather than leave it in the favour of the sportsbook.

This is not something that you can master overnight, though. It takes practice and understanding. But once you get the hang of expected value and variance, you stand a better chance of being successful over the sportsbook.