Fraud and scams are something that the online world puts up with on a daily basis. It’s pretty much present in all aspects relating to the internet. This person is trying to scam the other, a website is offering dodgy and fraudulent goods, etc. Since the early days of online betting companies have been experiencing people signing up with false details and using fraudulent payment methods to deposit money into their accounts. In the past it has been something that has been rife within the UK gambling industry.

Fraud and scams are something that the online world puts up with on a daily basis. It’s pretty much present in all aspects relating to the internet. This person is trying to scam the other, a website is offering dodgy and fraudulent goods, etc. Since the early days of online betting companies have been experiencing people signing up with false details and using fraudulent payment methods to deposit money into their accounts. In the past it has been something that has been rife within the UK gambling industry.

However, when online gambling was licensed in 2005 one of the core objectives was to create a framework that would prevent the use of the gambling industry for crime and fraud. Over time these guidelines have been added to with progressive increases in verification procedures, source of funds checks, and the use of credit for gambling.

Even in spite of new rules is fraud still something that happens in the same way that it always has? Have fraudsters found a way around new rules or is it being clamped down on so severely that fraudsters have stopped their tricks and made a U-turn? Well, that’s what we’re here to look into today. While we know that fraud most likely still goes on, can it be said that there are new and alternative loopholes that people are exploiting to commit such acts? What are the major ways that people commit fraud at gambling sites today?

Furthermore, is it more detectable? Or are these methods so flush that fraudsters are able to scam their way in with the masses and bypass the so-called security features? If so, have any companies experienced a backlash from the Gambling Commission with regard to failing in this area?

What Do We Mean By Gambling Fraud?

It’s an unfortunate thing, but there are always criminals in operation who pretend to provide legitimate gambling businesses and then go about stealing players’ identities or money. That’s why it’s always ideal for you as the player to be aware of which site they’re joining and to ensure that they’re fully licensed and regulated to operate in the UK.

It’s an unfortunate thing, but there are always criminals in operation who pretend to provide legitimate gambling businesses and then go about stealing players’ identities or money. That’s why it’s always ideal for you as the player to be aware of which site they’re joining and to ensure that they’re fully licensed and regulated to operate in the UK.

Yet, we’re not specifically talking about online sites scamming you, but the opposite – players defrauding betting sites.

There are certain punters who have taken it upon themselves to out-rightly defraud a casino or bookmaker out of money.

This sort of operation has even found itself being quite prevalent in various TV shows and movies. You only need to watch something like Ocean’s Eleven to understand what it’s all about. Over the years, there have been some genuinely impressive scams that have occurred, although many of these took place within land-based establishments.

Gambling fraud can roughly be grouped into the following categories.

- Using stolen or criminal money to gamble with or persuading someone else to bet for you with legitimate funds.

- Using someone else’ account to gamble or creating accounts to gamble using a false alias.

- Bet and match-fixing or using information about match-fixing to gamble.

- Use of artificial intelligence or other tech to defraud a site or their games.

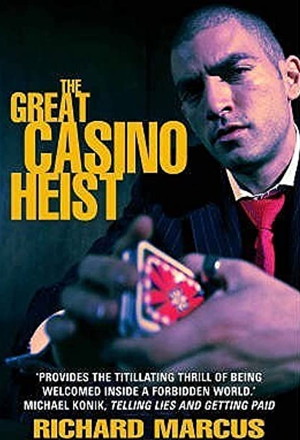

Richard Marcus Proves That Those Who Can, Teach

Richard Marcus has proclaimed himself as the ‘World’s #1 Casino and Poker Cheating Expert’. We’re not sure if that’s a moniker we would want to go by, but Marcus has certainly taken it as a positive thing. He even managed to build his own business up off of the back of his schemes and has taken to teaching other potential cheats just how it’s done. That’s quite the achievement for a man who was once homeless on the streets of the Vegas Strip.

Richard Marcus has proclaimed himself as the ‘World’s #1 Casino and Poker Cheating Expert’. We’re not sure if that’s a moniker we would want to go by, but Marcus has certainly taken it as a positive thing. He even managed to build his own business up off of the back of his schemes and has taken to teaching other potential cheats just how it’s done. That’s quite the achievement for a man who was once homeless on the streets of the Vegas Strip.

After obtaining a job as a croupier at one of the casinos there, Marcus realised that he could make bets in such a way that he would be able to fool the game’s dealers into thinking that his bet was smaller than it actually was. At that time, $5 chips were red and $500 chips were brown. So, Marcus would place the brown chip on the bottom and the red chips on the top in such a way that the dealer believed all to be red. Should that bet win, he’d reveal that it was actually a $510 bet for example, rather than a $15 one. If it lost, he’d utilise sleight of hand to replace the brown chip with a red one and the dealers in Vegas were none the wiser.

That scam lasted for years, and it’s believed that through this, Marcus garnered himself millions of dollars from the Las Vegas establishments. Eventually, he was caught, and found himself prosecuted, as well as being banned for life from the casinos. That didn’t stop him from being known for his gambling scams around the world, and he likely did well from the funds he gained utilising such fraudulent activity.

Of course, this took place on land, and not in the online sphere. So, what would constitute as an online fraud or scam?

Online Fraud in Gambling

Cybercriminals are also heavy at work in the online world, setting out to defraud any person or business that they can. Betting sites have been heavily affected by this over the years, resulting in various losses of players’ funds and their own. What counts as some of the top types of online gambling fraud?

Bonus Abuse

Online casinos and betting sites are all actively competing against one another for customers. And it’s often the case that these sites will try to outdo each other with their bonus rewards.

They bring new players into the platform, who enjoy receiving “free money”. Yet sometimes, players will sign up for multiple accounts in order to receive multiple bonuses. Of course, winnings from bonuses need to go through a certain amount of wagering before they can be withdrawn. And to achieve this, those players will work in collusion with others to guarantee profits.

Many of these people are caught but who knows how many get away with it. In the past eWallets such as Skrill and Neteller have been used to to do this due to the lower security involved in checking who customers are compared to a bank account. This allowed people to create multiple accounts and aliases. It is one reason these payment methods are commonly excluded from offers these days.

On occasion genuine customers come into the crossfire and have their accounts limited for bonus abuse when that was not the true intention.

Collusion

When two or more players work together to manipulate a certain outcome or an individual opens many accounts to accomplish the same thing, this is known as collusion. Generally speaking, online poker has been targeted by collusion schemes more so than anything else, but sportsbooks and casinos have also been affected by it.

Let’s say two players sign up and make a £500 deposit to receive a £50 registration bonus. They can then simply lose to each other in several games of poker to meet the rollover requirements for such. Of course, this results in them being able to both walk away £50 richer. And if several people collude with one another in one go, it can result in large amounts of money being taken from gambling sites.

Chargeback Abuse

A chargeback will usually occur when a legitimate account holder contacts their bank or card issuer and denies making any sort of deposit to an online gambling site. Many online gambling companies are located overseas, so the card company will frequently see this as a standard fraud issue on the company’s behalf.

Therefore, they will reverse those charges, leaving the gambling site holding the bag. Such chargebacks taking place often can thoroughly damage a betting company’s reputation with card issuers.

The ban on credit cards for gambling in the UK from 2020 has gone a long way to abrogate this.

Card Fraud

High-profile data breaches have been reported numerous times over in recent years, resulting in people’s credit card information being leaked to others. This allows some cyber criminals to utilise the stolen card information to deposit funds into an online sportsbook or casino, and generally, nobody is any the wiser.

This particular form of fraud has been clamped down on a lot in more recent times though, and it is pretty much non-existent now with the Gambling Commission banning credit cards from being used at online gambling sites.

This still does go on for debit cards where details have been stolen but with modern verification rules it is much harder to do.

Match Fixing and Inside Information

You don’t have to be the one doing the match-fixing to be a party to it. If you act on inside information, say place a bet on a selection you know will do something specific because it is prearranged, then you are a fraudulent party.

Often the people doing the match fixing don’t want to place massive bets on it otherwise it would be obviously suspicious so they get lots of people to bet smaller amounts and give them each a cut. This may be tempting but it is absolutely illegal.

Criminal Or Stolen Money

If you are given money to bet with by a stranger it is likely stolen or illegal and if caught could land you in a lot of trouble if you use it to bet with. Many criminals have used the betting industry in the past to launder money, fixed odds betting terminals in betting shops have been commonly used for this purpose – although less now due to £2 stake limits from 2019.

It is less common online because of the increased difficulty in doing it but it still occurs. Other instances are less malicious as many people have been caught stealing money from companies mainly to fuel a gambling habit. This is still fraud but in these instances the offender is also often the victim at the same time and so the penalties are more aimed at rehabilitation than punishing the person.

Technical Methods

Again poker is in the spotlight here. It is common knowledge that online poker has been, and still is, the subject of abuse from AI software that can be developed for as little as £150. These bots can effectively play at a higher level than most humans and have seriously defrauded the online poker industry and damaged it’s reputation at the same time.

Casino games can be manipulated in the real world, there are a lot of examples where people have defrauded land-based casinos. Online, however, it is rare for a game to be hacked due to the level of security they have – not impossible but highly unlikely.

AI is also used to take advantage or incorrect or weak odds lines with sportsbooks, flagging these up so people can take advantage of unusually high odds – it is difficult to know whether this is fraud or just very clever betting though.

What Steps Have Been Taken to Stop Fraudulent Activity?

The United Kingdom Gambling Commission (UKGC) has enforced fines on gambling firms for failing to both protect customers and stop money laundering from taking place. This led to the largest fine handed out on record – £19.6 million in total in 2019. More than a third of that total was made up by a £7.1 million fine that was handed out to Daub Alderney, a casino operator that runs a number of online sites. The Paddy Power Betfair brand, which went through a rebrand to Flutter Entertainment, also received a £2.2 million fine for violations at its sportsbook.

How have companies taken measures to stop such activity, as well as other fraudulent activity, from happening so frequently? Well, following William Hill receiving a fine of £6.2 million in 2018 for allowing ten customers to deposit large sums of money that was the proceeds of criminal offences, the Commission clamped down on proper checks being made on customers. This includes a source of funds to check, both to ensure that the money being deposited isn’t from illegal activity, and that the customer can afford to utilise this money for gambling purposes.

The Commission also went as far as to hand out some sage advice to William Hill in how it can improve its procedures. It said that the company should:

- Develop systems and controls to reduce the risk of money laundering

- Ensure commitment to those systems from senior management

- Regularly assess the effectiveness of such controls

- Keep records of all customer transactions

- Train employees so that they’re able to carry out checks on customers and be informed on how to report any suspicious activity

- Appoint officers to deal with any reports of such suspicious activity

That became the sort of benchmark that the Commission set out for all licensees, with the regulatory body stating that they have a duty under the Proceeds of Crime Act (POCA) to report any knowledge of customers using the proceeds of crime to gamble. Any failure to comply with this is something that is considered an offence and that can carry a maximum penalty of five years imprisonment and/or a fine.

At the same time, The Money Laundering Regulations 2017 requires all gambling sites to conduct a written assessment of their risk to money laundering. Those regulations also state that enhanced due diligence must be carried out by any betting site on a customer that places bets totalling £2,000 or more in a 24-hour period.

These terms are put in place to not only protect other customers, but the gambling sites themselves from the threat of criminal activity. With the authorities laying down such a hard line with such companies, and fines already having been handed out for failures, gambling sites have picked up whatever slack they had before and incorporated higher security measures.

Prevention Measures Under Investigation

Some gambling companies have started looking into machine learning technology, which is capable of recognising and identifying fraudulent behaviour.

Some gambling companies have started looking into machine learning technology, which is capable of recognising and identifying fraudulent behaviour.

At the same time, it is hoped that this technology will be able to target and identify problem gamblers, based on social profiling. Generally speaking, it will allow casinos, sportsbooks, poker rooms and so on to utilise the software in a bid to swiftly and easily locate gamblers who are using odd betting techniques in a bid to increase their chances of higher pay-outs.

Of course, that will then negate the need for people to do the task, as algorithms will be coded into the software so as to flag any strange activity. For the time being, gambling companies are incorporating the Know Your Customer (KYC) policy, as heavily suggested by the Commission. This implores all licenced sites to request ID verification from UK players before they are able to deposit and bet. This checks the age of a person, whether they have self-excluded from gambling and their general identity matches the information inserted during registration.

However, there are still customers who manage to slip through the cracks.

The Last Word

It is for this reason that so many brands have been issued with fines and warnings in recent times, as the Gambling Commission tries to get a bit more of a grip on its erratic industry. The KYC policy has proved to be a little more successful, but fraudulent activity is still taking place.

It is for this reason that so many brands have been issued with fines and warnings in recent times, as the Gambling Commission tries to get a bit more of a grip on its erratic industry. The KYC policy has proved to be a little more successful, but fraudulent activity is still taking place.

This is why something that flat out locates and targets dodgy dealings in the form of a software would likely be of great use to the gambling industry.

Of course, there is an inevitable expense that would come with such technology. It’s costly to make a machine learn such skills, and contractors of such aren’t the cheapest people to hire in the world. That being said, it’s something that these sites really do need in these times.

The cybercriminal world is something that is constantly changing and adapting, meaning that before long, fraudulent activity will be able to bypass the current measures in place.