In many states of the United States of America it is against the law to place a bet on a sporting event but it’s entirely legal to trade stocks and shares. You can be involved in trading on currency markets, can sell short and hedge, but you’re not allowed to place a wager on the outcome of the Super Bowl (in most states).

In many states of the United States of America it is against the law to place a bet on a sporting event but it’s entirely legal to trade stocks and shares. You can be involved in trading on currency markets, can sell short and hedge, but you’re not allowed to place a wager on the outcome of the Super Bowl (in most states).

Why is it that financial trading is seen as a different type of gamble to placing bets on the outcome of a sporting event, when both outcomes are entirely unpredictable?

When the financial crash happened in 2008, there was little to no comeuppance for the traders that essentially destroyed they world’s economy, yet the world of gambling is seen by many as a vice that should be discouraged.

Isn’t trading just gambling by another name? Is it seen by most as being more acceptable because it is generally done by more elite people and is seen as a corporate exercise, or is there a genuine difference between the world of trading and that of gambling?

What Is Trading? What Is Betting?

In the Cambridge English Dictionary, betting is defined as ‘the activity of betting money, for example in a game or on a horse race’. Trading, on the other hand, is outlined as being ‘the buying and selling of shares and money’. Certainly when viewed like that, it seems as though trading is just betting but by another name. After all, both activities involve risk in return for a decent rewards. In fact, the risks are far higher in the world of trading and it’s an awful lot more difficult to trade for small amounts, whereas the ability to bet as little as ten pence exists in the world of gambling.

Madhuri Mishra, a Business Analyst, doesn’t agree with the comparison between trading on the stock market and gambling. She believes that successful gambling is about nothing more than luck, whilst trading stocks is about speculation. She believes that getting your timing right and doing as much as possible to mitigate your risks means that you can minimise the chance of loss at the same time as maximising your chance of making a profit. Whilst luck, according to Mishra, can ‘favour you sometimes but cannot favour you all of the time’, the ability to buy and sell stocks means that it falls into a different bracket.

It does make some degree of sense, of course. Whilst the world of Cashing Out in betting has added a degree of control to your fortunes, you’ll almost never find that the payout you’re offered to Cash Out reflects the market in the same way that selling stocks would. Ultimately in the world of betting you’re mostly up against a bookmaker who has their own edge to consider when creating their odds and making their offers, which is entirely different from trading. In trading people are paying what they think something is worth at that moment, either because they feel they’re buying it cheap or else they envisage it being worth more money in the future.

It’s About How Responsible You Are

Even the most hard-faced trader would admit that some of their colleagues play fast and loose when it comes to the manner in which they trade. They base it not on mathematical probability but rather on their gut feeling regarding which way the market is going to go.

Even the most hard-faced trader would admit that some of their colleagues play fast and loose when it comes to the manner in which they trade. They base it not on mathematical probability but rather on their gut feeling regarding which way the market is going to go.

When they do that it makes their business look far more like gambling than the methodical option that their colleagues opt for. Yet the reverse is also true in the world of gambling, with some people going with their instinct whilst others are far more methodical in how they bet.

Certainly in games such as poker and blackjack there are far more components at play that make it more like trading, with clever players putting themselves in a position where making certain choices can bring the odds down and shift the balance more in their favour then if playing the likes of roulette.

Gambling is speculation and the odds are never in your favour, with bookmakers and casinos the only ones that win consistently. Where luck is the deciding factor in gambling, in trading it is a combination of maths and common sense that mean that a good trader is always likely to make money in the long run.

Trading Isn’t The Same As Investing

An important distinction to draw is that between day trading and investing. The former is about reacting quickly to what’s happening in the market, whilst the latter takes a longer-term look at where things are going. An investment involves putting your money at risk in the hope of getting a bigger return further down the line. It’s a long-term strategy that involves a huge amount of research and investigation from people that plan to make significant money from doing it, along with the acceptance that it will take time to pay off.

That is in direct contradiction to day trading which is a fast-paced industry and lacks the ability to do research. In the world of day trading there is no such thing as a long-term investment, with the need to buy and sell securities an immediate and pressing concern. The hope for traders is that they can take advantage of a short-term discrepancy in the market, acting quick but limiting risk at the same time as looking to earn as much from each trade as possible. It is the world of day trading that has by far the most in common with gambling, but even then day traders respond to what the market is telling them.

Day traders work on the assumption that many of their trades won’t work out, but that as long as more than half of them do then they’ll end the day in profit. Because things move so quickly in the day trader world it’s a matter of constantly keeping things ticking over, far more akin to the In-Play market in the world of betting. Even so, the comparison isn’t perfect. In gambling the person faint the speculating on the outcome of a random event is hoping that their hunch or instinct will prove to be right and that they will win large profits that are just as large as their potential losses are likely. In that sense gambling is closer in nature to speculation, but even then speculators are able to offset their potential losses with hedged risks on options, futures or other securities.

Gambling Has A Negative Expected Value

Pretty much everyone that gambles understands that the house edge means that the casino or bookmaker will always lose in the long-term. Let’s take blackjack as an example of what we’re talking about.

Pretty much everyone that gambles understands that the house edge means that the casino or bookmaker will always lose in the long-term. Let’s take blackjack as an example of what we’re talking about.

The idea is for the player to get as close to 21 as possible without going over, whilst also beating the dealer. Because of the way the game works, the house has an edge that means it will always win in the long-term. The dealer might lose several games in the short-term but they know that over many thousands of hands the house will end up in the black. That mans that it is a game in which the expected value for the player is negative.

When it comes to trading, on the other hand, the work done by clever traders means that they can shift the expected value into the positive in much the same way that card counters can do when they’re playing blackjack. There’s a reason that most casinos don’t allow card counters, with that reason being the fact that it removes the house’s edge.

A set of trading rules that have been tested under market conditions are proven to work are essentially like removing the house’s edge, shifting the odds into the favour of the trader. Because the house always wins in the long-term, even small and regular victories for the majority of punters are more akin to short-term loans, with the money being paid back eventually.

Winning At Both Is Complicated

The simple truth is that you can profit in both gambling and trading if you know what you’re doing meaning that it is possible to find ways to ‘win’ regardless of which option you choose. The problem is that it isn’t easy, else everyone would be doing it. There are systems that can be brought into play in both things that we’re talking about, but they can be extremely complicated and don’t necessarily open themselves up to being pulled off by people that haven’t invested a decent amount of time, effort and energy into making sure that the systems work.

The simple truth is that you can profit in both gambling and trading if you know what you’re doing meaning that it is possible to find ways to ‘win’ regardless of which option you choose. The problem is that it isn’t easy, else everyone would be doing it. There are systems that can be brought into play in both things that we’re talking about, but they can be extremely complicated and don’t necessarily open themselves up to being pulled off by people that haven’t invested a decent amount of time, effort and energy into making sure that the systems work.

One such example of the sort of thing we’re talking about is known as ‘arbing’ in the world of betting. It involves working to extremely small fractions, meaning that making a profit in the region of 5% would be extremely difficult. Let’s say that you’ve bought a picture for £10 and decide to keep hold of it for a few months. It might well be that in a couple of months the picture is worth £11, meaning you’ve made a profit. Equally it’s possible that you could find that it’s only worth £9, putting it at a loss. Similarly you might be able to place a bet on a football team winning at 10/1 and later lay it at 9/1, meaning you’ve made a profit. You might have to lay it at 11/1, though, giving you a loss.

In a similar way you might find that you could place a bet on an event like a tennis match, that can only have two possible outcomes, and bet on both outcomes in such a way that you guarantee yourself a profit no matter what the actual result. Obviously this is a win-win method, but it’s tricky to pull off. A lot of people will try to do it using the Exchange market, but you need to remember that Exchanges work by taking a commission of winning bets and you’ll therefore need to add that into your calculations. Using free bets, promotions and offers is a good way of limiting potential losses, but you’re still depending on your ability to get the maths right in a similar way to how traders need their calculations to be correct to pull it off.

Should Trading Be Seen As Gambling?

The reality, then, is that trading is far more complex than betting and far less prone to the whims and dealings of fate.

The reality, then, is that trading is far more complex than betting and far less prone to the whims and dealings of fate.

There’s also the fact that there are countless different types of trades that can be done at any given moment, with Forex trading being another example of one that bears similarities to gambling on paper but in actual fact is significantly different from it. In essence you’re betting on the relative strength and success of a foreign exchange market, which can change at any given moment. The fast-paced nature of the changing market is what makes it more akin to gambling than trading, with a split second decision having the possibility of becoming bad news quickly for the trader.

Yes ultimately Forex trading, like any other form of trading, is mathematics rather than gambling. You could write a formula that comes close to guaranteeing you a profit as long as you know what you’re doing, where no such thing can be said about gambling. Even bets that seem like bankers and sure things can turn out to be pigs wearing lipstick, thanks to the variables that exist in sport that don’t exist in the markets in quite the same way. A refereeing decision, injury or the weather can all have an impact on the outcome of a sporting even that is different to the world of market trading.

Even the financial collapse was about more than just a couple of trades that didn’t go right, do the comparison between it and gambling isn’t quite fair.

You Will Likely Pay Tax On Trading But Not Gambling

Gambling is regulated by the gambling commission under the Gambling Act 2005 and amendment in 2014.

Gambling is regulated by the gambling commission under the Gambling Act 2005 and amendment in 2014.

Following rule changes in 2001 it effectively means you do not pay tax on gambling winnings in the UK, although conversely of course you can’t write off any loses either.

It is a little more complicated than that as in reality you still are paying tax its just that its the bookies and casinos that pay it directly, as a point of consumption tax. Therefore tax is factored into odds before you even bet, but at least you then don’t need to declare winnings or pay tax on them.

Financial trading is regulated by the Financial Conduct Authority and this means any gains made from financial trading (or spread betting) are classed as income, and you are liable to pay income tax.

This also means you can submit some losses as a tax write off too, but something to be very aware of before you start.

Is Trading The Same As Spread Betting?

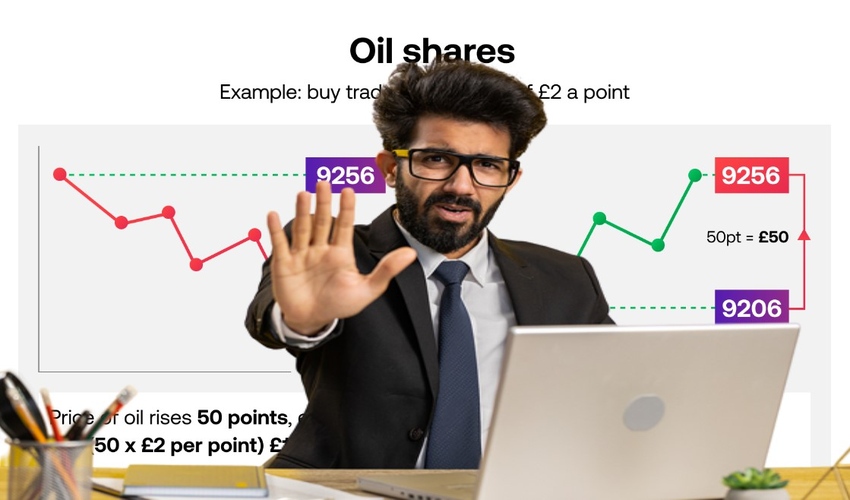

Spread betting is a form of trading with limited factors and outcomes.

Spread betting is a form of trading with limited factors and outcomes.

With spread betting, you bet whether something (such as a currency market) will go up or down, and the amount you win or lose is proportional to the degree of movement.

This is also regulated by the FCA but the main attraction is that it is free from any sort of tax. That said, it is also a much more dangerous way to gamble for the uninitiated as you can easily lose everything if you get it wrong, or if you miss a big price movement.

With CFDs (contracts for difference), which isn’t quite the same as spread betting but in the same ball park, you can actually end up losing more than you stake. It’s scary.

There are now many forms of sports trading too, where you can do things like trade on player performance in a football game. While these look on the face it like typical betting sites, they are not, and just as with trading you can lose a lot very quickly.

You can read more about spread betting on our dedicated page.

We Don’t Recommend Trading Sites, Why?

We believe gambling should be a leisure activity, it should be fun, and you should only bet what you can afford to lose. The reason we don’t recommend trading or spread betting sites is because it is an easily way to end up with runaway debts.

The fact you can end up being liable for more losses than you have money in your account can be highly dangerous, this is simply not possible with a normal betting site. Therefore, you should only ever trade or spread bet if you understand what you are doing and the risks involved.

Trading and spread betting sites might offer you all sorts of incentives to sign up, and these can seem very attractive vs a typical bookie, but bear in mind you could end up losing far more in the long run.

If you have questions about trading you should seek professional independent advice, from an qualified financial advisor, or someone who can explain the risks involved in detail so you can trade in an informed manner.